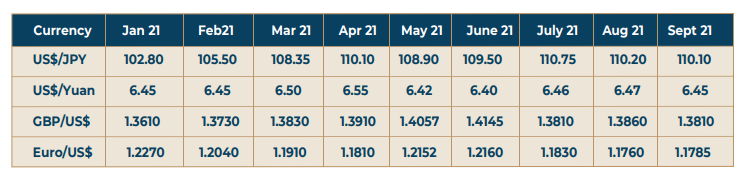

The US Dollar is thriving on the safe-haven status, and the prospects of higher rates in the US consequent to the higher rate of economic growth and higher price level. With the probability of the bond purchases coming down with likely tapering coming up towards the end of this year, the US Dollar is going to hold its sway in the currency markets. The Pound Sterling is already weaker with the measures like higher taxation coming up to pay for the pandemic-related measures and its adverse impact on consumption mainly by the middle class and the young spenders. The quantitative easing is likely to run its full course till the end of the year but the slowing down of the current activity and the eventual hike in rates is what the markets are speculating on. The Euro too is under some pressure from the US$ related factors primarily and the ensuing German elections due in a week’s time. Growth in

Germany is expected to be quite robust in Q3 and it may be stable in Q4 of this year according to German official sources. The Yen has been in a consolidation phase around the 110 mark in the last three months. It still remains close to that level with little movement away from this level. But the most stable of them all is the Yuan and it is perched on to the 6.45 level. The underlying trend in currencies remains one of Dollar strength, and with the currency yield entirely in favour of the currency, Dollar is likely to retain its strength in the coming months. There is also a trend of asset movements away from some emerging markets into US Dollar denominated assets, and this may add to the demand for Dollars.