The Dolar Index has been in narrow ranges all through the last one month. The reason for this is the lack of any fresh triggers. The Index traded between 104.10 and 105. 55 in the last one month. The last three months range has been 103.30 to 106.30. In the last update on currency the view that was shared was – “the currency movements are amplified by the movement in the Dollar Index….in the last six months it has not moved higher than 106.80. The crucial resistances are 106.30 and 106.80. The current move does not have the fire to move beyond these levels. However, one factor that may be able to support a further dollar surge is a cut in the euro zone interest rates and the ECB has shown an inclination for a rate cut as inflation is gradually coming down, and inflation expectations are lower.” In fact, the ECB cut the base rate by 0.25 % but it was widely expected and most of it was priced in by the markets already.

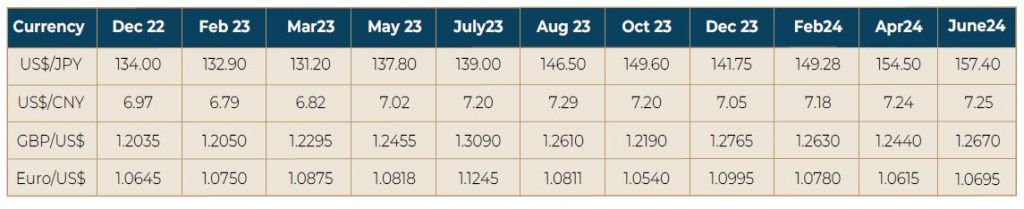

The Bank of England is also preparing to cut the rates at an early date. For any significant fall in the Dollar, the Dollar interest rates should start declining, and this is possible only with the Fed acting to cut the base rate. The Euro has been weakening and it may continue to as the rate cut has already taken place, and Europe is going through snap elections in France, and also in the UK. This will help the Dollar to hold well against the Euro and the Pound Sterling. The strength of the Dollar against Yen is also expected to sustain and technically it may move up to 158/159 levels, and from there to 163 level. However, one factor that needs to be recognized is that consequent to any reduction in US interest rates, the probability of funds located in the US moving out to Japan cannot be ruled out.

This prospect applies to all leading emerging markets, including China and India. The cut in US rates would enthuse funds that chase high risk-high returns to leave the US shores for the other markets. The prospects of the Rupee will also be linked to the inflows from overseas investors. There is a dichotomy observed in the trends seen in the flows to equities and fixed income. The fixed income has seen inflows to the tune of US$ 7.30 billion (CYTD), and an outflow of US$ 3.70 billion from equities. Any improvement in the inflows alone would help the Rupee appreciate from the current levels, Rs.83.60. The inflows into the bond market is expected to gather momentum due to the index inclusion of local government bonds in leading indexes. Any inflows into equities will be dependent on the trajectory of US interest rates.

In the absence of inflows emanating from investment demand, the Rupee may slide as the pressure on account of payables, mainly imports, will put pressure on the currency. There is no relief that trade can offer. However, even with inflows in case the RBI goes into buy Dollars from the market it may prevent the Rupee from appreciating beyond a set level. RBI has resorted to such purchases in the past to shore up the reserves and to supply Rupee liquidity to the markets, also as measure of smoothening the money market conditions. But the impact may be limited if there is a move to sterilize the impact of fresh liquidity by sales of government papers. Therefore, the trajectory of the Rupee is dependent on multiple factors. Therefore, the policy of covering a major part of the payable, like 45 % , is a prudent approach to managing the currency risk.