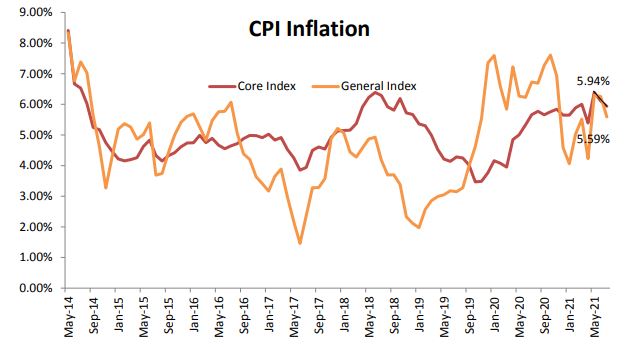

The CPI based inflation has moderated and it has fallen within the RBI’s target range of 4% +/- 2% after a gap of two months. The headline CPI inflation wasreported at 5.59% for the month of Jul’21 as compared to 6.26% for the preceding month and 6.73% during the year ago period. The easing in food inflation helped the moderation of headline numbers, but the core inflation remained sticky at close to 6% level.

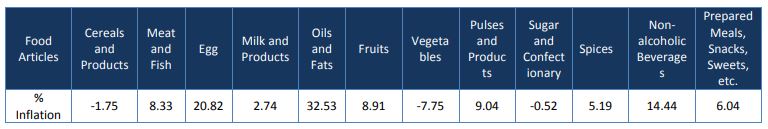

The Consumer Food Price (CFP) inflation eased sharply from 5.15% reported in the month of Jun’21 to 3.96% for the month of Jul’21. The easing in CFP index inflation was supported by the fall in prices of fruits and vegetables, and continued sluggishness in Cereals and Sugar & Confectionary prices. On the other hand, inflation for Oils and Fats component in the food basket remained elevated at 32.53%; India being a net importer of edible oils saw the pass through of rising prices in CPI inflation. The other food components to witness a double digit rise in inflation were Egg (20.82%) and Non-alcoholic beverages (14.44%). After registering high single digit to double digit for an entire year, prices of pan, tobacco and intoxicants component inflation has started easing due to beneficial base effect; inflation for the component was reported at 4.71% for the month of Jul’21. The inflation for other components such as Clothing and

Housing hardened marginally, whereas Miscellaneous reported easing.

Fuel Prices: Brent has come down below the US$ 70 mark after a long while. The main reason that has caused this fall is the emerging demand conditions which may not be favourable as China faces one of the worst outbreaks of the pandemic since the first wave in late 2019. Transport services and movement of people has been either suspended or restricted between many larger cities and towns in an attempt to contain the spread of the pandemic. This may depress the demand

for oil in the immediate term as China along with India forms the largest chunk of demand for fuel. Any fall in demand from these territories directly affects the price and usually this has an impact that gets transmitted over a few months. There has been slowdown in the economic activity in China in the recent months, and some amount of enhancement of supply after the OPEC+ agreement with UAE on unwinding of inventory build-up, also will support lower prices. But we cannot expect any drastic fall in prices at this juncture and the levels US$ 68 and US$ 63 would act as strong support levels.

Core Inflation: The core inflation continued to ease for the second month in a row but the momentum slowed down, indicating stickiness. The core inflation came in at 5.94% for the month of July as compared to 6.11% seen in the preceding month. The Pan, Tobacco and Intoxicants inflation has been in double digits for the last one year, but the fall in the sequential growth has led to beneficial base effect kicking-in. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 6.71% in the month of July as compared to 7.21% in the preceding month. The inflation for Miscellaneous component is expected to remain elevated at the current juncture as the lockdowns are lifted, but the momentum may slowdown of the spread of the delta variant increases.

Outlook: The easing of CPI based inflation within the target range may afford the central bank some breathing space in its endeavour to support economic growth. Going by the RBI’s inflation guidance in its latest monetary policy statement, the inflation is expected to remain sticky closer to current levels. As per the RBI’s latest estimates, headline inflation is projected to be at 5.7% for FY22. Further the policy document states that, “The available data, point to exogenous and largely temporary supply shocks, driving the inflation process, validating the MPC’s decision to look through it. The supplyside drivers could be transitory while demand-pull pressures remain inert, given the slack in the economy. A pre-emptive monetary policy response at this stage may kill the nascent and hesitant recovery that is trying to secure a foothold in extremely difficult conditions.” From an Indian context, the focus of the central bank seems more towards the factors influencing inflation rather than the nature of it, sticky or transitionary. The snippet from the policy statement, mentioned above, indicates that the policy stance may remain accommodative till the time the inflationary pressures emanate from supply side shocks. The transition to a stable economic growth and demand-pull pressures influencing inflation may become the key triggers for RBI to change its stance.