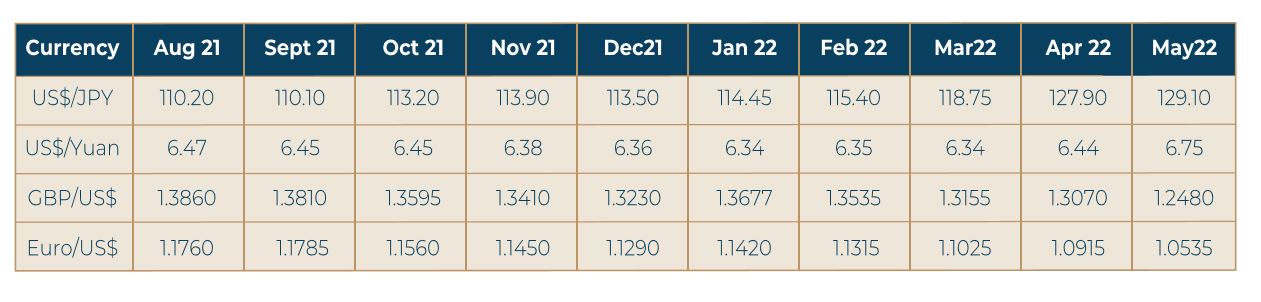

The US Dollar put up a splendid show of strength in the last few months, and it accelerated further in the last three weeks. The Dollar Index moved up to 104.85 on May 12 22, and thereafter, retreated a bit to the 103.40 level. This surge was from the lowest level seen in two months, 100.39 on April 20 22. The big figure has changed in all the majors signifying substantial gains across currencies. The recent statements from Bank of England on the potential for lower growth and much higher inflation in the UK has created a negative environment because of which Pound Sterling was sold off. The closure of major cities and industrial units in China to prevent the spread of the pandemic has put immense pressure on production, demand and distribution in China. This has weakened the local currency, for the first time in almost a year, the stability in the currency has been lost. The Dollar could see some correction but that may not be a trend reversal. The interest rate outlook for the Dollar remains positive with Fed looking to tighten again to slay the demon of inflation. The pressure on the Rupee continues unabated due to the strength of the dollar, the exit by FIIs from the domestic market, and the worsening of the trade balance. While the RBI may have nothing against a gradual depreciation of the currency, a sudden depreciation amounting to a speculative attack will be contained by the central bank. A revival in macro-economic conditions, a return of the overseas funds, and an improvement in global trade conditions are required for a revival in the fortunes of the Rupee.