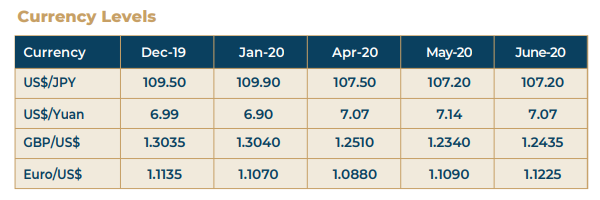

The US Dollar is holding well due to its safe-haven status, and this is mainly occasioned by the spread of the corona infections throughout the world and it does not seem to be abating at this point of time. Therefore, there is a preference for investors to hold on to dollar assets and currency. But a more realistic consideration for market players is that economic growth is going to come back not in a hurry, and it may take more time than expected. Interest rates have been cut very aggressively and this has brought down the currency yield which acts as a disincentive to holding currencies. The general perception is that the game of war between the US and China will be a protracted one, and that may also affect global trade, and certain regional equations. Significantly, the Euro has displayed a tremendous amount of resilience in the face of adverse global developments.

To read the full Navigator issue, click on the banner below